Impact Of Age And Retirement Timing When Choosing Between Immediate And Deferred Annuities!

When planning for retirement, one crucial decision you’ll encounter is whether to choose an immediate or a deferred annuity. According to a 2023 report by the Insurance Information Institute, nearly 40% of retirees find themselves uncertain about this choice. Understanding the main difference between immediate and deferred annuities can guide you in making a well-informed decision that aligns with your age and retirement goals.

Let’s check out these options to determine which might be the best fit for your financial future –

What Are Immediate And Deferred Annuities?

To start, let’s clarify what each type of annuity entails:

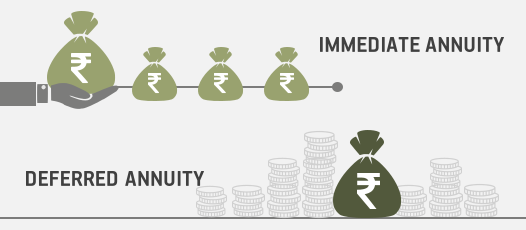

- Immediate Annuities provide payments almost immediately after you make the purchase. You can start receiving regular income within a month or two.

- Deferred Annuities begin payments at a future date, allowing your investment to grow before you start receiving income.

The main difference between immediate and deferred annuities is the timing of payments. Immediate annuities deliver instant income, which is useful if you need immediate cash flow. Deferred annuities, however, offer payments at a later date, which can be beneficial if you plan ahead and want your money to grow before retirement.

The Role Of Age In Your Annuity Choice

Your age is a critical factor in deciding between these two options. Here’s how it affects your decision:

Younger Individuals:

If you’re younger and still have several years before retirement, a deferred annuity might be the better choice. For instance, if you’re 50 and plan to retire at 67, purchasing a deferred annuity now allows your investment to grow over time. This could lead to a larger income stream when you retire.

According to the National Retirement Institute, those who invest in deferred annuities at a younger age often see a significant increase in their retirement income compared to those who opt for immediate annuities.

Near-Retirement Or Retired Individuals:

For those approaching retirement age or are already retired, an immediate annuity may be more suitable. For example, if you’re 65 and about to retire, an immediate annuity can provide you with a steady income right away. This can help maintain your lifestyle without the risk of outliving your savings.

Choosing The Right Annuity For Your Situation

To determine the best type of annuity for you, consider your current age, retirement plans, and when you will need the income. If you’re close to retirement or need immediate cash flow, an immediate annuity is likely your best option. However, if you’re younger and can afford to wait, a deferred annuity might offer a larger and more secure income in the future. By considering these factors, you can make an informed choice that aligns with your financial goals and ensures a comfortable retirement.

For those of you who are unaware or cannot figure out how to move forth in making a decision, you can find the answers at Independent Life and Annuity Agents Inc! Your needs are my priority. Whether it is differentiating between annuities or picking the correct flexible premium immediate annuity plan for you, I am there at every step to assist you.

Let me help you find the insurance solutions that work best for you, with the professionalism and care you deserve!