Life Insurance

TAKE THE WORRY OUT OF LIFE WITH INSURANCE PROTECTION

~ RELY ON YOURSELF!

~ RELY ON YOURSELF!

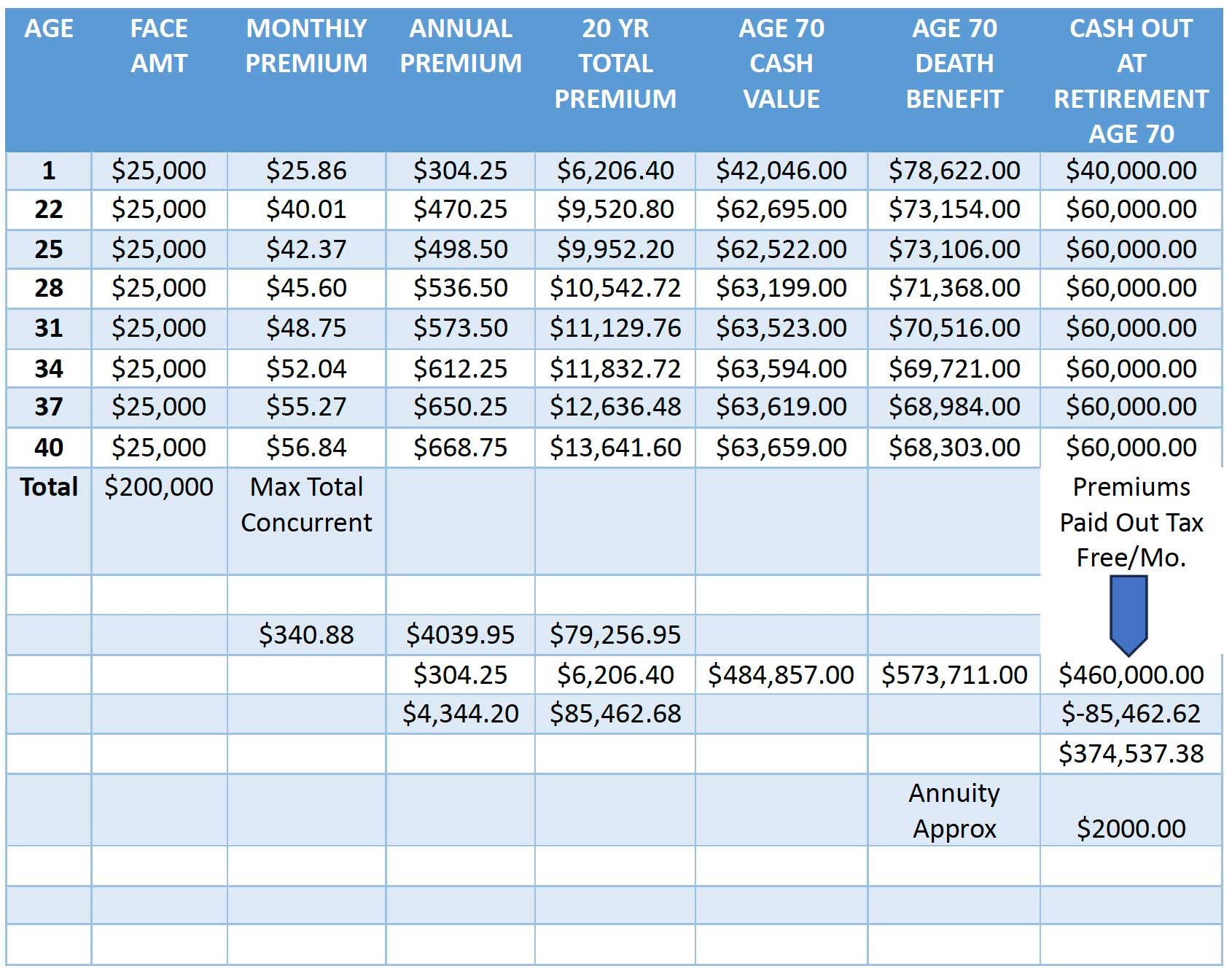

Your children could use money throughout their lives, right? A 401K means the money is locked up. A rely on yourself policy grants financial independence and the bank of “mom and dad” is closed when they move out! Below is an actual example of a plan prepared by CWT Consulting LLC that helps your children become financially independent.

What follows is a brief layout of a 401K

The Revenue Act of 1978

Ted Brenna designed the 401K so employees could defer taxation on their savings until they retired and were in a lower tax bracket. Today he laments his creation stating that it wasn’t meant to be what it is today. Employers were supposed to cover the fees. Then there’s stock market losses, inflation and higher taxes.

Mr. Brenna now uses stacked annuities and life insurance in his own retirement plan. Note: stacked annuities can be of different terms and either deferred or immediate payout contracts.

Starting at age 30 you have tax deferred savings of $23,500 per year for 35 years until you retire at age 65. That’s $1,958.33/month of untaxed money with the expectation of a lower tax rate in retirement.

When have taxes gone down?

So, in 35 years you’d have $822,500 in principal and hopefully after fees you add $177,500 more in interest to add up to $1,000,000. That’s your accumulation over time. When you go to the payout phase, you’d get about $5,000/month for the rest of your life.

This is a simplified example for illustration purposes only.

The spreadsheet below shows that using life insurance at an early age and adding to it over time provides cash values that exceed 50%of the above example 401K using much less money to do it. The example uses a very small face value or death benefit policy.

Obviously, you can double or triple your policy premiums and still be considerably under the MAX 401K contribution. Either way, the person responsible for sending money to your retirement is you!

Another advantage is that the premiums are paid with after tax money so money withdrawn at retirement up to the value of the premiums paid would be tax free.

Plus, unlike a 401K you have easy access to the cash to borrow repeatedly.

But wait, there’s more! The policies used are special in that they behave as if you’ve never touched the cash and they continue to grow!

OR

Sample Illustrations

The illustrations below will show you how Rely on Yourself policies can benefit you throughout your life. Each of these illustrations are actual policies my sons and myself carry.

It’s Not Too Late to Take Control of Your Financial Future

The word RESCUE has the same letters as SECURE. Where would you like to be when it’s time for you to retire? Don’t fall into the 401K trap, worrying about how to RESCUE your retirement. Flip the letters and work with us to SECURE your retirement.

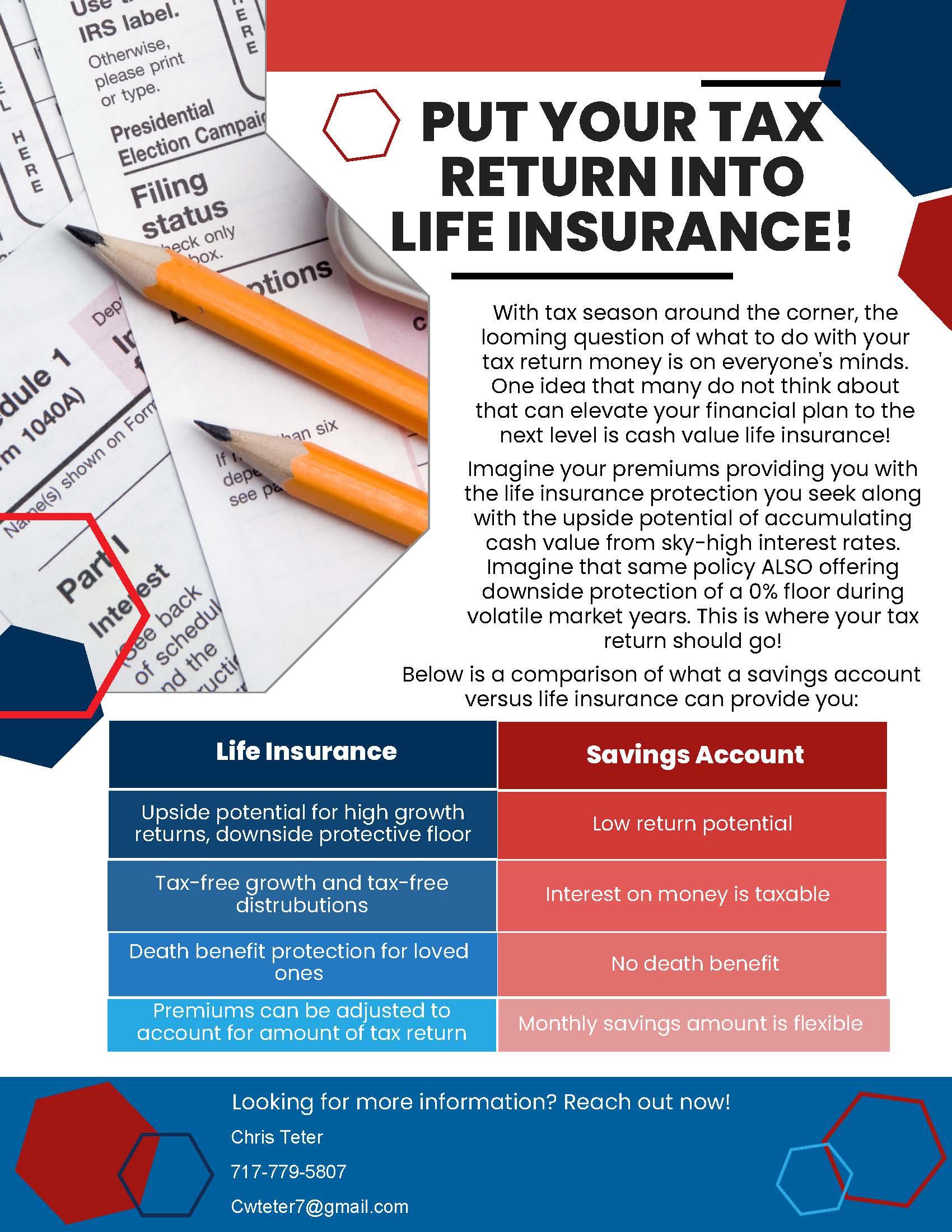

What if you could:

- Have tax-free access to your retirement savings on the day your retire?

- Know the guaranteed minimum value of your retirement savings on the day you plan to access them and at every step along the way?

- Have your savings grow by a larger dollar amount every year – guaranteed?

- Never again worry about another market downturn that wipes out your traditional 401k by 30% to 50% or more?

- Be able to access your money when and how you want, with no penalties or restrictions for accessing your money?

- Increase your overall wealth simply by using your plan to pay for major purchases, rather than going to a bank begging for a loan?

Sound to good to be true? It isn’t! If you want to rely on yourself we cam create policies that help! Request a free consultation below and let’s start you on the path to financial freedom!